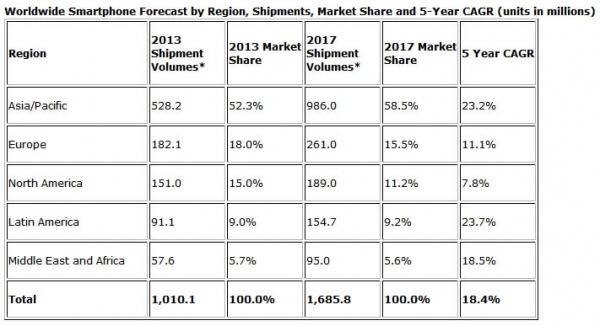

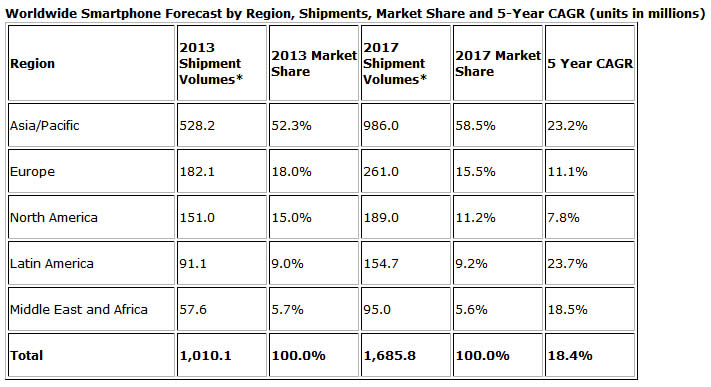

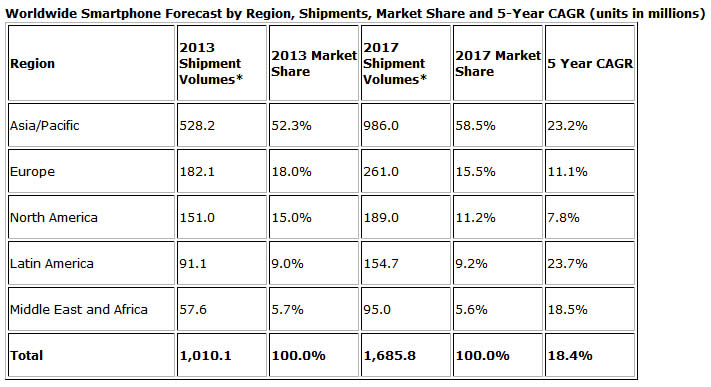

A new report published by the International Data Corporation (IDC) has predicted that global smartphone shipments in 2013 will exceed 1 billion units in 2013. That signifies a growth of 39.3 per cent compared to the previous year.

Even more impressively, it forecasts that in 2017 a total of 1.685 billion smartphones will be shipped worldwide, resulting in a compound annual growth rate (CAGR) of 18.4% over the 5 year period.

Worldwide, smartphones continue to grow at an impressive rate even though the European and North American smartphone markets are quickly approaching saturation point. The driving force behind the increase in smartphone shipments is rapid growth in emerging markets, namely the Asia/Pacific, Middle East and Africa and Latin America regions.

Features phone used to rule the roost in the 3 emerging markets, but the widespread availability of low-cost smartphones has led to them becoming available to a new breed of consumers, who could only previously only afford feature phones.

"Just a few years back the industry was talking about the next billion people to connect, and it was assumed the majority of these people would do so by way of the feature phone. Given the trajectory of Average Selling Prices, smartphones are now a very realistic option to connect those billion users." said Ryan Reith, Program Director with IDC's Worldwide Quarterly Mobile Phone Tracker.

Over the next 5 years smartphone prices in emerging markets will continue to tumble, resulting in a 20% (CAGR) average increase in smartphone shipments in the 3 emerging markets. In the Asia/Pacific region alone smartphone shipments will rise from 528 million in 2013 to 986 million in 2017.

While, in the saturated European and North America markets the 5 year growth in smartphone shipments will sit at just 11.1% and 7.8% CAGR respectively. Average smartphone prices in the diverse European market are still expected to drop (-9% CAGR) in the next 5 years, but in the US prices are actually expected to rise by 2.1%.

Challenges to manufacturers

The rise in demand for affordable smartphones has led to an influx of new manufacturers producing low-cost smartphones, including Huawei, ZTE and Lenovo. This has forced the established manufacturers to drive down the cost of their devices or risk losing sales to the new breed of manufacturers.

Apple are still yet to tailor a device for the emerging markets, but Samsung have launched a strong assault with a new range of affordable Android smartphones. It's a difficult position for high-end smartphone manufacturers: who have to offer affordable devices without negatively affecting their premium branding.

Nokia have been the company most affected by the demise of the feature phone market, which has always been their home ground. Those switching to smartphones are moving away from Nokia feature phones to Samsung device or those from regional manufacturers, such as MicroMax in India or Yulong in China.

Nokia's Asha range and a more affordable breed of Lumia smartphones, such as the recently unveiled Lumia 525, will go some way to helping. But it's quickly become one of the most competitive marketplaces in the mobile world.

Who will win out? Only time will tell, but its a big market so should be room for a number of major players.

Source